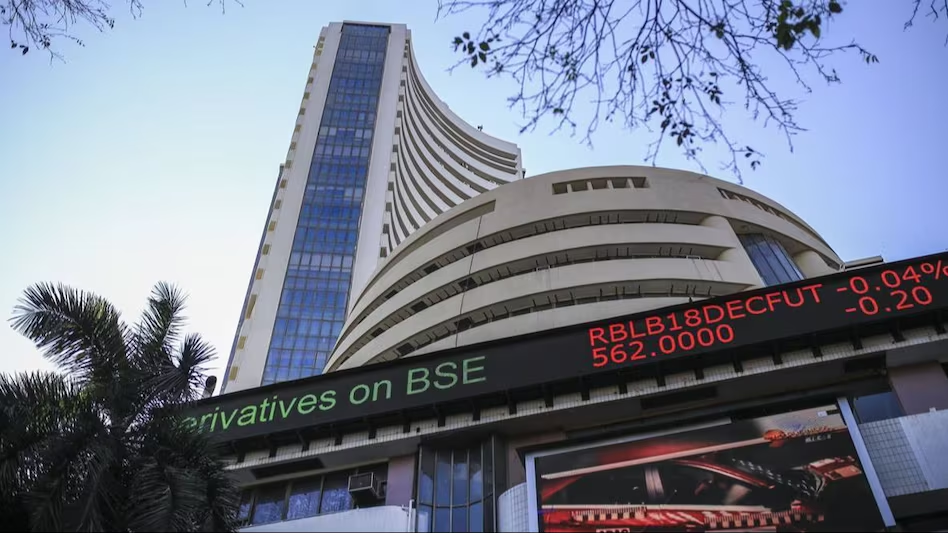

BSE Share Price Understanding the recent plunge in BSE share price? We explain why BSE shares tumbled 19% today following a directive from market regulator SEBI. Get the latest insights on the regulatory fee dispute and its impact on the stock exchange.

BSE Share Price Tumbles 19% on SEBI Order: A Breakdown of the Controversy

The Bombay Stock Exchange (BSE), one of India’s leading stock exchanges, witnessed a dramatic fall in its share price on Monday, April 29, 2024. BSE shares plunged a staggering 19% on the National Stock Exchange (NSE) following a directive issued by the Securities and Exchange Board of India (SEBI). This sudden drop BSE Share Price has sent shockwaves through the Indian financial market, prompting investors and industry experts to seek clarity on the situation.

SEBI’s Order: The Core of the Issue

The root cause of the BSE share price decline lies in a recent order issued by SEBI. The market regulator directed BSE to revise its payment of regulatory fees on the annual turnover, specifically for option contracts. According to SEBI, BSE has been calculating this fee based solely on the premium value of these contracts. SEBI, however, contends that the fee should be calculated using the “notional value” of the options.

Just look – Bajaj Finance

Understanding Option Contracts and Notional Value:

Option contracts grant the buyer the right, but not the obligation, to buy or sell a particular security at a predetermined BSE Share Price price by a specific expiry date. The premium is the upfront cost paid by the buyer to acquire this right. The notional value, on the other hand, refers to the underlying value of the security linked to the option contract. In simpler terms, it represents the actual value of the stock or asset that the option pertains to.

SEBI argues that using the notional value for calculating the regulatory fee provides a more accurate reflection of the overall turnover generated through option contracts. This revised calculation method would result in a significantly higher fee for BSE.

BSE’s Response and Potential Implications

The BSE, in response to SEBI’s order, issued a statement acknowledging the directive. They indicated that they are currently evaluating the validity of SEBI’s claim. Experts believe that while BSE might contest the order, considering its role as a regulatory body itself, a full-fledged legal battle is unlikely.

The immediate consequence of this regulatory dispute is the significant drop in BSE’s share price. Investors reacted negatively to the news, fearing the potential financial burden imposed by the revised fee structure. This could impact BSE’s profitability and overall financial health in the near future.

Looking Ahead: Potential Scenarios and Market Impact

The future trajectory of this situation remains uncertain. Here are some potential scenarios to consider:

- BSE Accepts SEBI’s Order: If BSE accepts SEBI’s order without challenge, it will have to comply with the revised fee structure. This could lead to a one-time financial strain but might pave the way for a more transparent and standardized fee calculation system in the long run.

- BSE Challenges SEBI’s Order: In case BSE decides to contest SEBI’s directive, a legal battle could ensue. This would likely prolong the BSE Share Price uncertainty surrounding the issue and potentially further impact BSE’s share price. The final outcome of the legal proceedings would determine the applicable fee structure.

- SEBI and BSE Reach an Agreement: A more amicable solution might involve SEBI and BSE reaching a mutually agreeable fee calculation method. This could involve a compromise or a phased implementation of the revised structure to minimize the immediate financial impact on BSE.

The outcome of this regulatory dispute will have a ripple effect on the Indian stock market. Here’s how it could potentially impact various stakeholders:

- Investors: The volatility in BSE’s share price might discourage some investors from holding or buying BSE stock. The final resolution of the fee issue will influence investor sentiment towards the exchange.

- Other Stock Exchanges: The outcome BSE Share Price could set a precedent for how SEBI calculates regulatory fees for other stock exchanges as well. This could potentially lead to similar revisions in fee structures for other market players.

- Market Transparency: A clear and standardized fee calculation method could enhance transparency and fairness within the Indian stock exchange ecosystem.

Key Takeaways and the Road Ahead

The recent tumble in BSE’s share price highlights the importance of regulatory oversight and adherence to established financial practices. While the short-term impact is evident, the long-term consequences of this dispute hinge on the resolution reached by SEBI and BSE.

Investors are advised to stay informed about BSE Share Price developments and carefully consider the potential risks before making any investment decisions related to BSE or the broader Indian stock market.

resource –BSE shares

Disclaimer: tajakhabar online provides stock market news for informational purposes only and should not be construed as investment advice. Readers are encouraged to consult with a qualified financial adviser before making any investment decisions.